tax sheltered annuity limits 2021

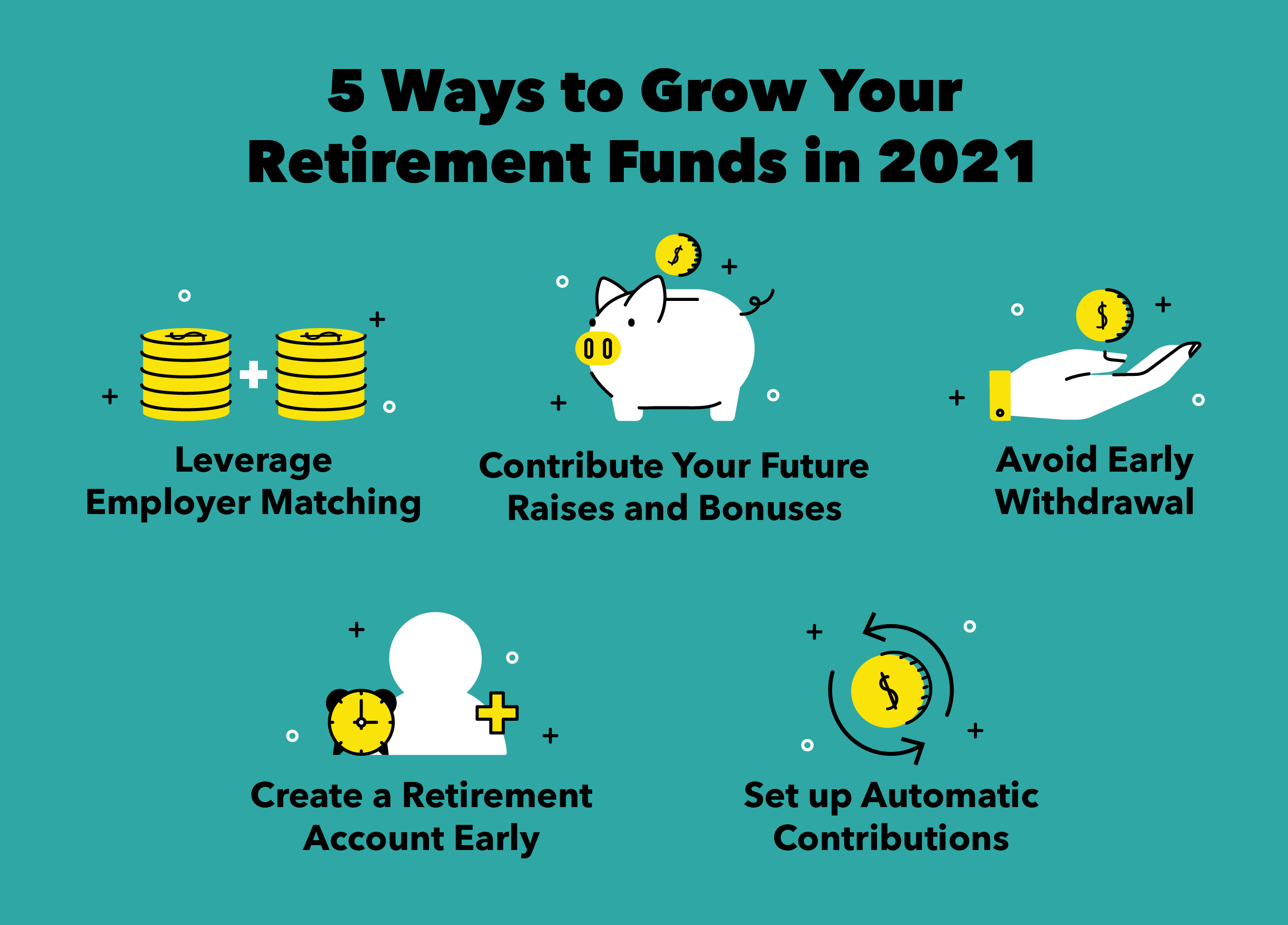

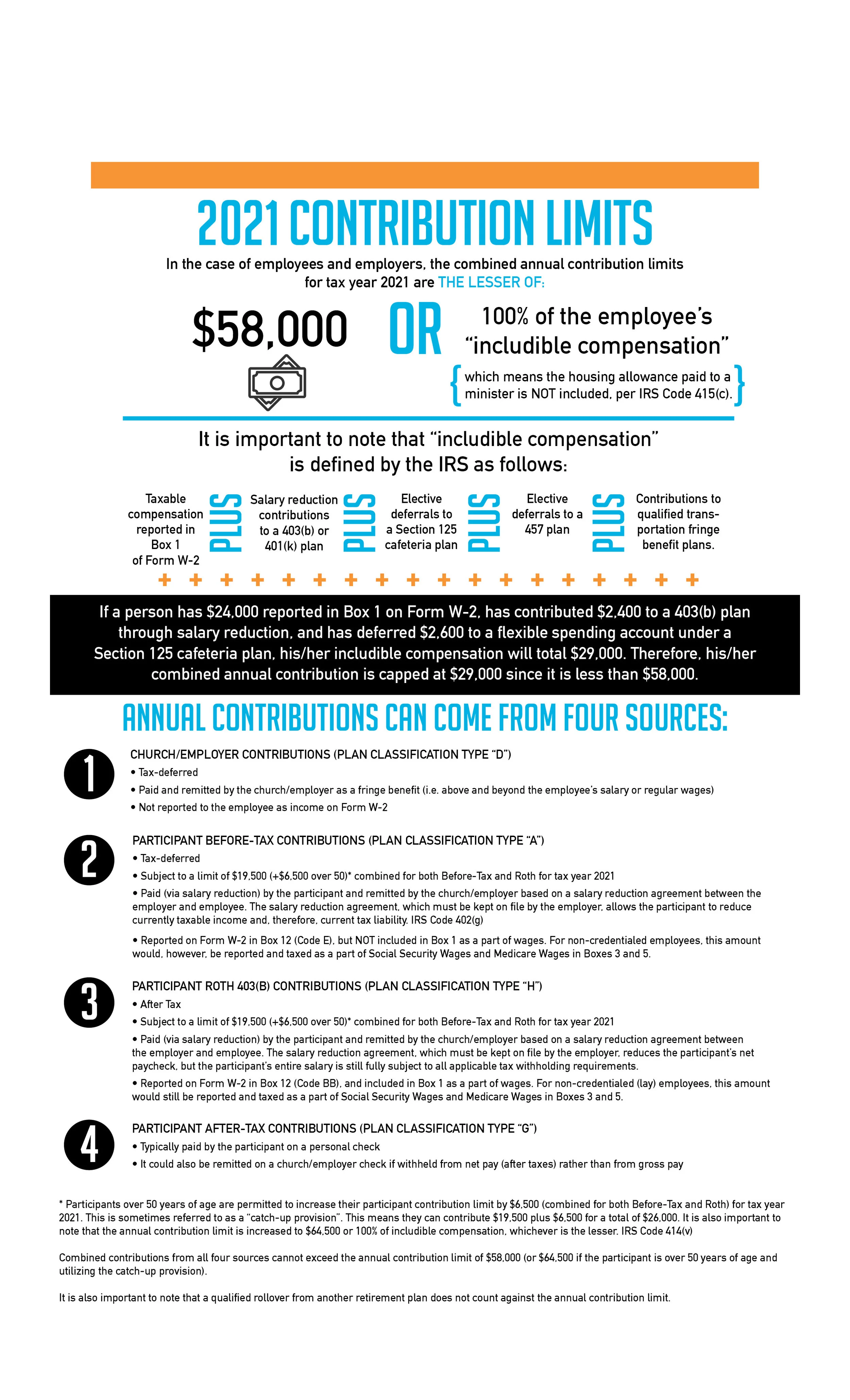

The total of elective deferrals and matching contributions is limited to 61000 for the 2022 tax yearup from 58000 in 2021. Tax Sheltered Annuity Plan is a voluntary savings program that allows employees to make pre-tax andor post-tax contributions to various mutual funds and insurance company annuities.

Can I Contribute To Both A 403 B And 457 Plan

The maximum amount you can contribute to a 403 b plan from your salary for 2022 is 20500 up from 19500 in 2021.

. Few governments provide matching programs within. If youre 50 or older you can add a. Kaiser Permanente Tax Sheltered Annuity Plan This plan helps you build retirement savings while lowering your current taxable income.

The tax rates are updated periodically and might increase for. Employees save for retirement. For State Employees Civil Service Board.

The limit on elective deferrals Voluntary Tax-Sheltered Annuities remains unchanged at 19500 for 2021. For 401k plans the total contribution limit including catch-up contributions is 64500 for 2021 and 67500 for 2022. A 403 b plan also called a tax-sheltered annuity or TSA plan is a retirement plan offered by public schools and certain 501 c 3 tax-exempt organizations.

1 These limits are indexed for inflation so they can be. 2021 Income and Rent Limits. You can also choose Roth after-tax contributions or a.

2021 Income Limits and Maximum Rents. The limit on the maximum. The Form W-2 reflects wages paid by warrantsdirect deposit payments issued during the 2021 tax year regardless of the pay period wages were earned.

The age 50 or older catch-up provision remains unchanged at 6500 for 2021. The 2021 Form W-2 includes. SUTA Tax Rates and Wage Base Limit.

Home- CTCAC- Low-Income Housing Tax Credit Programs- 2021 Income and Rent Limits. The IRS recently announced the 2021 contribution limits for the UW Tax-Sheltered Annuity TSA 403 b Program and the Wisconsin Deferred Compensation WDC 457 Program. For more information about the TSA Plan please view the Nevada System of Higher Education Tax Sheltered Annuity 403 B Plan Document.

The Internal Revenue Service IRS announced yesterday November 4 2021 the following dollar limits applicable to tax-qualified plans for 2022. The limit on catch-up contributions to a 401 k plan a 403 b tax-sheltered annuity or a 457 b eligible deferred compensation plan for persons age 50 and older is. Diversity Equity.

2021 Contribution Limits Deferral Limits for. Each state has its own SUTA tax rates and taxable wage base limit.

What Are Tax Sheltered Investments Types Risks Benefits

403b Plan Retirement Benefits Wellness Bcn Hr Shared Services University Of Nevada Reno

What Tax Deferred Annuities Are And How They Work

Qualified Vs Non Qualified Annuities Taxation And Distribution

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

/101405194-5bfc2b8c46e0fb0051bddfc9.jpg)

Top 403 B Plan Questions Answered

Withdrawing Money From An Annuity How To Avoid Penalties

2021 Retirement Contribution Limits Servant Solutions

What Does Active Participant Mean Find The Answer Here

Irs Announces Higher 2022 Retirement Account Contribution Limits For 401 K S Not Iras

Sec 457 Government Plan Distributions Compared To 401 K Distributions

Sec 403 B Retirement Plans A Comparison With 401 K Plans

Publication 590 A 2021 Contributions To Individual Retirement Arrangements Iras Internal Revenue Service

403 B Plan How It Works And Pros Cons The Motley Fool

Irs Publication 571 Tax Sheltered Annuity Plans 403 B Plans Awesomefintech Blog

:max_bytes(150000):strip_icc()/GettyImages-1341890406-85ae77715fe4428191fe7622f79c35c0.jpg)

:max_bytes(150000):strip_icc()/Safe-Retirement-Withdrawal-Rate-57a521625f9b58974aa2b94a.jpg)